How To Put Money In Fd Deposit Of Own Account Federal Bank

How To Eolith Money Into Your Bank Account

- At a Bank Branch

- How To Fill Out A Eolith Slip

- At an ATM

- Mobile Check Deposit

- Other Options

- Availability of Funds

RyanJLane / Getty Images

Depositing money into your bank account safeguards the funds and makes them available for you to spend or withdraw when you demand information technology. Deposits are an essential cyberbanking chore, and at that place's more than one way to make them. Continue reading to learn about dissimilar ways to eolith your paychecks, cash and other forms of money into your checking or savings account.

How To Deposit Money at a Bank or Credit Union Branch

Depositing money in person at a depository financial institution or credit marriage branch is the easiest way to add cash to your account. It's also the nearly versatile way in terms of the types of payments you can eolith and the number and dollar amount of payments you can eolith at i time.

Yous usually need to make full out a deposit slip to deposit money at your bank branch. Each bank has its own eolith slip with the bank's proper name and perhaps its routing number on it. You tin use the preprinted deposit slips the bank or credit union provided when you opened your account, or you can use one of the blank slips typically provided within the foyer. Filling it out properly ensures that your coin is deposited into your account correctly and without delay.

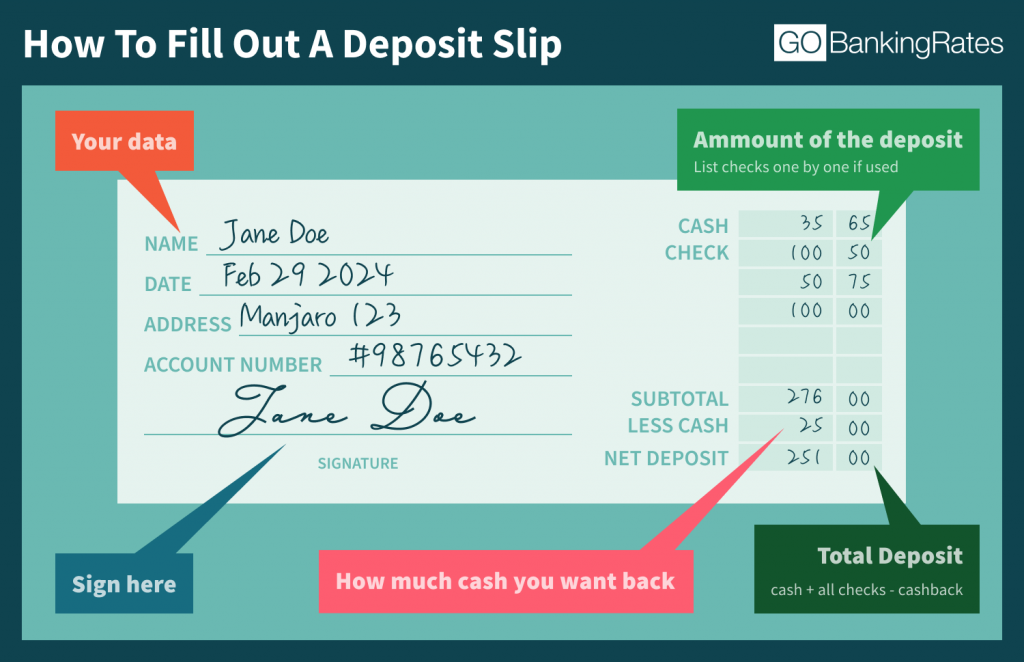

How To Fill Out A Deposit Sideslip

- Your proper noun: Print your first proper name, middle initial and last name on this line.

- Your address: Print your street address, urban center, state and ZIP code in the assigned spaces.

- Your account number: The account number is commonly found in the middle department of numbers at the lesser of the checks in your checkbook, or on monthly statements for your checking or savings account. You tin also find it when y'all log in to your online account.

- Appointment of the eolith: Print the appointment you're making the deposit.

- Amount of the deposit: On what will ordinarily exist the right side of the deposit slip, y'all'll run across several lines with designated unmarried-space boxes meant to hold a single number. List the full amount of cash you're depositing in the infinite indicated, and list each check separately, writing the check number on the line and the respective bank check amount in the box.

- Cash back: For check deposits from which you're taking back some greenbacks, write how much greenbacks y'all want back on the designated line.

- Total deposit: Add upward the individual deposits and write the amount in the subtotal box. Subtract whatever cash-back amount, and write the amount that remains in the "total" space.

Go along in mind that checks generally must be endorsed before you lot can deposit them.

How To Deposit Money at an ATM

You can make greenbacks or check deposits at any ATM that accepts them, even if the ATM is exterior of your bank's network. Still, look a filibuster if you're not using your own bank'south machine.

Count your cash and endorse your checks before you arrive at the ATM. Once there, insert your debit or ATM bill of fare and follow the on-screen prompts to make your eolith. These are the steps yous'll likely need to follow to brand an ATM deposit:

- Insert your debit card and punch in your Pivot to access your business relationship. Alternatively, use a mobile wallet for a no-contact ATM transaction.

- Select "deposit" from the transaction types bachelor.

- Select the account you lot want to receive the money.

- Insert your cash into an envelope if one is provided, and write any data indicated on the envelope. Insert the greenbacks and/or checks into the machine when prompted.

- Wait for your receipt. Keep it in a rubber identify in example there's a problem with your eolith.

Expert To Know

Notation that some banks place restrictions on ATM deposits. Wells Fargo, for example, doesn't permit foreign check or currency deposits, and it limits deposits to 30 checks or bills.

How To Brand a Mobile Cheque Deposit

If yous make a mobile check deposit, you lot don't need to fill up out a deposit slip. For most banks, you lot'll just admission your banking company account online with a mobile banking app on your smartphone.

Here are the steps to exercise that:

- Log in to your account.

- Snap a photograph of your check.

- Confirm the dollar amount and other details as requested.

- Your mobile eolith is made.

Before yous try to deposit annihilation other than a personal, business, cashier's or government cheque drawn from a U.Southward. depository financial institution, cheque to make sure your bank'due south mobile deposit feature allows it. Banking concern of America, for example, doesn't permit mobile deposits of traveler's checks or money orders.

More Ways To Deposit Money Into Your Banking company Account

Standard in-co-operative, ATM and mobile deposits aren't your only options for depositing money. Here are some more:

- Direct deposit: Direct deposit lets you receive recurring payments, such as paychecks and regime benefits, directly to your depository financial institution business relationship. You can enroll online to receive regime benefits this way. To have your paychecks direct deposited, fill out a direct eolith form provided past your depository financial institution or employer.

- Business relationship transfer: If you have more than than i account at your bank, y'all can apply mobile or online banking to eolith funds past transferring them from another account.

- External transfer: Some financial institutions let yous link accounts held by different banks. Once you've connected the accounts by following the bank's instructions, which yous'll mostly discover in online banking, you tin can transfer money betwixt the accounts.

- Wire transfer: If someone wants to send you coin from their account at a different bank, or from a service like Western Marriage or MoneyGram, they tin schedule a wire transfer. Although y'all and they might be charged a fee, wire transfers are secure and tin can be initiated quickly in most cases. Nevertheless, you'll accept to share your banking concern information with the individual sending you coin, so don't concur to a transfer from a business or private yous don't know well.

- Peer-to-peer transfer: Money-transfer apps and platforms like Zelle, Venmo and PayPal let you receive coin from other people. You tin can so transfer the payment to your linked bank account if the app doesn't send it there automatically. Note that transaction amounts might exist limited, and you could incur a fee.

When Will Your Deposited Funds Be Available?

Your banking concern has a funds availability policy that determines how long yous'll need to wait before yous'll have access to your noncash deposits. Many banks allow you lot to take a set amount of money, such as $100, immediately. The rest is then available to you on the designated day.

Kim Olson contributed to the reporting for this article.

Bank check Out Our Free Newsletters!

Every day, get fresh ideas on how to relieve and make money and accomplish your financial goals.

Source: https://www.gobankingrates.com/banking/banks/how-deposit-money-bank/

Posted by: denhamgoolifter.blogspot.com

0 Response to "How To Put Money In Fd Deposit Of Own Account Federal Bank"

Post a Comment