How Much Money Do I Need To Open A Franchise

🕒 Estimated Reading Time: ~16 minutes

"How much does it cost to first a franchise?" is one of the virtually often asked questions by prospective franchisees. But the answer—as it rarely is—isn't as piece of cake as the question.

General Franchise Opening Costs

Note: While these costs below are mutual, they may not apply to every franchise organization.

The Wall Street Periodical suggests being prepared to pay around 20% of the initial investment from your ain money. But how much volition it exist? Short answer: it varies.

There are thousands of franchise opportunities out there, all with different execution requirements, some only requiring a few thousand to start. However, if yous want a more direct answer, according to franchising industry expert Michael H. Seid, founder and managing director of Michael H. Seid & Associates, the initial investment for a single unit franchise typically falls in the $100,000 to $300,000 range.

Why such a large, and truly hard-to-define range? Some franchises crave franchisees to have commercial property, some tin can exist based from dwelling house. Some franchises need specialized equipment, others don't. The area the franchise will be located volition also take an effect on toll as well.

Check the franchise disclosure certificate (FDD) of a specific franchise brand for details on its investment costs, and don't be afraid to ask the franchisor any questions you might have.

The FDD is an invaluable resource to have every bit you put together your upkeep for franchise investment. You tin request an FDD, which must adjust to Federal Trade Commission (FTC) guidelines, from a franchisor at any fourth dimension but you must receive 1 to review at least ii weeks earlier signing any contracts with a franchisor.

Inside the FDD, the initial investment for the franchise is covered in item within Items 5 and seven. Regardless of the franchise, there are some mutual costs involved with the buy of a franchise. The get-go of those costs is the franchise fee.

The franchise fee is basically a encompass charge for entry into a franchise system. Think of information technology as the fee you lot pay the franchisor for doing the legwork developing the make, and saving you from many (non all) of the pitfalls that come with starting a business from the ground up.

Other common opening fees for franchises include:

- Full general role supplies and equipment.

- Industry-specific equipment.

- Leasehold improvements and construction, if existent estate is needed.

- Signage and decor, if not a habitation-based franchise.

- Inventory (if needed).

- Professional fees (e.chiliad. legal, licensing, accounting, etc.).

- G opening advertising/marketing.

- Insurance.

- Taxes.

The chart beneath is an instance illustration of how the initial investment estimate is presented in an FDD for a new franchise unit of measurement. The data for the chart was compiled from the 2018 FDD for Upkeep Blinds.

| | | |

| Initial Franchise Fee | $19,950 | $nineteen,950 |

| Initial Territory Fee | $70,000 | $70,000 |

| Additional Territory Fee (if 2nd territory purchased at the same time as the initial territory) | $0 | $lx,000 |

| Excess Costs of Training | $250 | $2,500 |

| Work Vehicle | $5,000 | $48,000 |

| Computer | $1,000 | $3,500 |

| Credit Carte du jour Processing Engineering science | $xxx | $500 |

| Telephone Equipment | $threescore | $120 |

| Automobile Insurance | $500 | $ii,400 |

| Commercial General Liability Insurance | $500 | $ane,500 |

| Contractor's License and Bond | $0 | $one,500 |

| Additional Tools and Supplies | $100 | $1,500 |

| Professional Services | $750 | $three,500 |

| Additional Funds—first three months | $12,000 | $xx,000 |

| ESTIMATED TOTAL | $110,140 | $234,970 |

Finding Loans for Your Franchise

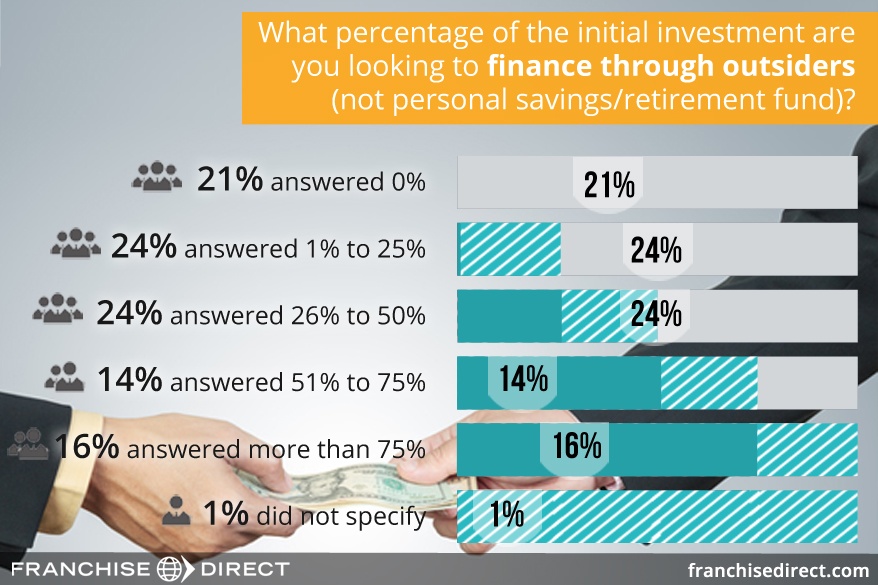

(Graph office of our Prospective Franchisee Survey results, which tin exist viewed hither.)

Preparing for the Financial Search

Since most people can't finance the full cost of a franchise on their own, a coming together with a financial institution similar a depository financial institution or credit matrimony will be in order for many prospective franchisees. Luckily, according to an editorial in Franchising World mag, lending conditions have get much more favorable in the last five years.

Before meeting with potential lenders, information technology will be to your benefit to prepare your documents in advance. Not only volition it help expedite the process, it volition help you show the lender you can be trusted with the responsibilities of a franchise business. Lenders strive to take on as little risk as possible.

The get-go thing you demand to ready is a resume roofing your personal groundwork. Detail your educational and work history, forth with your proof of residence. In add-on, collect your personal (and business, if applicable) financial statements for at least the prior 12 months, including banking company statements and credit statements. It'southward also recommended you collate your tax returns for the prior three years.

When deciding whether to approve credit for an applicant, lenders often consider the following, which Wells Fargo refers to as the "v Cs":

- Capacity: What is your ratio of debt to income?

- Capital: What other than expected income, in terms of savings, investments, etc., exercise you take that can aid repay the loan?

- Collateral: Volition the loan be secured or unsecured? If secured, what are you pledging buying of that has value if you were to default on the loan?

- Atmospheric condition: How is the coin going to be used?

- Credit history: What is your track tape of making on-time payments?

A large office of your financial background preparation will be covered in your credit written report. Credit reporting companies Equifax, Experian, and TransUnion each independently runway purchasing and payment history, along with job and residency history. Your credit reports can be obtained through AnnualCreditReport.com, a regime website that provides streamlined admission to complimentary annual credit reports.

Sometimes the data on one person can vary from bureau to bureau. If yous find inaccuracies in any of your credit reports, you can have it corrected past contacting the appropriate bureau(s) with the contact data given on their respective websites.

Lenders usually also use a credit score to evaluate your loan awarding in addition to your credit study. All three credit bureaus generate their ain credit score based on the information within their respective systems. Credit scores are commonly chosen "FICO scores" because they are generated using plan software from the Fair Isaac Corporation (FICO).

FICO scores range betwixt 300 and 850, and give the lender an overall feel of your credit situation. The higher your FICO score, the better.

Elements used to determine the score are:

- Payment history: 35%.

- Amounts owed: 30%.

- Length of credit history: 15%.

- Credit mix: 10%.

- New credit: 10%.

The weighted percentages given above are for the general population. The importance of factors tin can vary slightly from person to person depending on his or her unique situation. However, all FICO scores are based upon the information from your credit report, so it's paramount to review your credit report regularly for accuracy.

The conditions factor of the 5 Cs discussed above is covered past another document you will need to prepare earlier applying for financing: a concern plan.

Typical parts of a business organisation plan include:

- An executive summary: An overview of the business plan and the goals you accept for the business. Many have found it best to write this summary final, even though it's presented first.

- A visitor (in this case franchise) description: Draw the franchise yous want to open in detail.

- Marketplace analysis: Tell most the business organization manufacture the franchise is a office of with special attention paid to how it will do good your specific expanse. Outline your competitors and how you fit into the big picture.

- Management structure: Who are you as a business concern person? Requite some groundwork in this section. If franchise buying is going to be a group endeavour, outline the organizational chart and who will play which office.

- Description of product or service: What are y'all selling specifically?

- Marketing and sales programme: How are you lot going to get people to know yous exist? How are you going to get them to buy from you?

- Financial projections: This section should include at to the lowest degree a greenbacks flow statement detailing your needs at present and into the future, and revenue projections for at minimum the outset year of operation.

- Funding request: Lay out a comprehensive statement of how much money you will need from the lender, including best estimates on when it will be paid back.

- Appendix: The appendix serves every bit the spot of items that don't fit into any other section, but you feel is important to show lenders to give them a full picture of you lot and your goal. Items such as resumes, media clippings you might have, and pictures of potential sites tin exist here.

The franchisor is a groovy resource in completing this step as much of the needed data tin can be found in the FDD. Some franchisors even disclose potential earnings figures based on historical results from franchisees in the system (Item 19). Plus, some franchisors provide a business plan outline for prospective franchisees to utilize.

For more, see our guide for creating a business plan for your franchise.

SBA Loans

In searching for financing options for your franchise, yous'll probably come beyond franchises that state they are "SBA approved" or something to that effect.

Unfortunately, that phrase doesn't mean that you volition automatically receive funding from the Small Business Administration (SBA) if the franchisor approves you for its franchise organization. In authenticity, the SBA itself doesn't loan money directly at all. The agency offers partial guarantees for the loans to the banks that participate in its programs.

SBA approval refers to steps franchisors have taken to brand the loan process as brusque as possible for their potential franchisees. During the loan application procedure, lenders have to vet the person they're giving their money to, as well every bit the business system they want to run. In a franchise situation, that means vetting the franchisee and franchise organisation itself.

Franchises that have received SBA blessing are declaring that they've gone through a formal process with the SBA, essentially pre-vetting itself for time to come loan applications. Equally a result, the SBA loan procedure is simplified, or streamlined, for the franchisee—not entirely avoided. The potential franchisee all the same has to evidence that he or she is a expert candidate for the loan.

It's similar to TSA Pre-cheque at an drome. Travelers with TSA Pre-cheque notwithstanding have to go through security, merely since they've already registered with the appropriate government they don't accept to spend equally much time going through the security line as everyday travelers.

SBA loans are a common form of outside financing for franchisees. For instance, in 2016 near 5,500 franchise businesses used SBA-backed loans at a full of around $770 million.

Approximately 10% of all SBA loans are to franchisees, and they take a maximum of $2 million per loan. The almost common SBA loan for franchisees is the General Pocket-size Concern 7(a) loan. For more this loan plan, visit its page on the SBA website.

Other Forms of Franchise Financing

Below are other means prospective franchise owners can finance their franchise dreams, beyond the traditional loan route. Also provided are brief, real-earth examples of how some franchisees used the various methods to acquire the necessary funding to achieve their franchise ownership goal.

Franchisor Financing

Check Item 10 of the FDD to come across if the franchisor offers financing options to its franchisees, or works with affiliates to assist franchisees with funding. While withal not a majority, more franchises are providing financing assistance to franchisees to combat the electric current tight lending environs. Examples beneath are accurate equally of the 2018 FDD of each corresponding franchise:

- Someday Fitness: Has arrangements with a number of third-party equipment lenders who provide financing to franchisees, if they meet qualifications. The franchisor also has two direct financing programs that offering financing to qualifying franchisees to help finance tenant improvements, one of which is for new franchisees, and 1 for existing franchisees who are renewing their franchise.

- MaidPro: May offer financing to qualified credit worthy prospective franchisees for the buy of a Select Market for $v,000 of the Initial Franchise Fee and a line of credit of upwards to $twenty,000 that can be used towards future payments equally the franchisor prescribes.

- Signal 88 Security: Offers franchisees financing for their "ordinary, reasonable, and necessary business expenses" once franchisees begin operating their Franchised Business. The franchisor may also, from time to time, and at franchisees' asking, assist them in obtaining financing from a third-party for all or function of their investment.

Also, under Item 10 yous will find out if the franchisor volition help guarantee a franchisee'due south loan, or take on a measure of responsibility for the payment of part of the loan if the franchisee were to default (not be able to pay).

Franchisor financing case study: with his good credit score and solid track record as a businessman, Remi Tessier idea it would easy for him to acquire financing for a Marco'due south Pizza franchise in Warner Robins, Georgia. However, that wasn't the case.

He disliked the terms and weather he was presented with after going through the lending procedure with multiple banks, going as far as to call them "outrageous." Equally a result, he turned to his franchisor, Marco's Pizza, for assistance. Through the company's leasing program he eventually received $250,000 toward the initial cost of opening the pizza restaurant.

Family and Friends

There are two principal ways prospective franchisees gain financing from family and/or friends. The beginning is having a family unit fellow member or friend bring together in the franchise as a partner, sharing the fiscal and operational load of the business—and likewise the profits that come. The second is a family fellow member or friend offers a loan, which the franchisee pays dorsum.

Before accepting the coin in either of these scenarios, create an agreement with all parties involved outlining the terms and conditions of the organisation in writing. Strongly consider employing professional person assistance from a lawyer in drafting the agreement and then all parties are adequately protected.

Agreements with family unit members or friends shouldn't differ in construction from agreements signed with 'normal' concern partners. The goal is to have clarity on expectations beforehand to lessen the potential of hurt feelings downward the road.

Financing from family and friends case study: when Sandip Patel moved to the U.s. he was "financially unstable [all the same] did not want to piece of work for any one." He had a desire to own a Dunkin' Donuts franchise, but had to find a way to come up with the initial investment. He found a lender in his cousin, already a Dunkin' Donuts franchisee, who loaned him $120,000 to go started.

The arrangement included Sandip making monthly lump sum payments to his cousin for reimbursement. In addition, his father loaned him an additional $150,000. With the support of his—and his family's—Sandip's franchise ambitions flourished. He eventually opened 4 Dunkin' Donuts and 4 Taco Bell franchises.

Sandip'due south recommendation to other prospective franchisees is to take careful consideration and planning before accepting a loan or entering partnership with family unit (or friends). "I had proper documentation and everything was in depth. I [nevertheless] have a solid continuing human relationship with my family."

Online Marketplaces and Intermediaries

Nowadays, prospective franchisees tin link up with lenders online. A popular one of these sites is Boefly. Boefly operates much like a dating website.

After creating an account, borrowers on Boefly create a loan request that is matched to "uniform lenders" from the organization's 5,000 lenders and banks. From there, the borrowers and potential lenders make contact with each other, eventually completing the loan process. Franchisees from Toppers Pizza, Groovy Clips, Subway, Pizza Hut, and more take utilized Boefly to fund their franchise ventures.

Another financing market franchisees can utilize is Biz2Credit. Biz2Credit helps entrepreneurs secure franchise business financing through its network of hundreds of lenders via online profiles. Co-ordinate to the visitor, it tin can adjust SBA loans, traditional banking company loans, business lines of credit, equipment financing, business acquisition loans, commercial real estate loans, refinancing and merchant cash advances. Additionally, in that location are special lending programs available through Biz2Credit for women, veterans and minorities.

However another intermediary choice to finding financing is FranFund, which positions itself equally a "concierge" of the funding process. People who use the service are paired with a financial consultant that guides them through the funding process, including figuring out which selection will work best for them.

Online market case study: Already founders of a packaging visitor, Les and Claudia Davis sought to farther expand their business portfolio with a TCBY frozen yogurt franchise.

From prior experience, this husband and wife duo understood the funding procedure and sought to make their latest venture every bit painless as possible. They consulted with their franchisor most financing, and TCBY recommended BoeFly. Later creating their loan request on BoeFly's website, they received several inquiries from interested lenders. Following a shut evaluation of offers from across the country, they chose a bank located nearly them in Richmond, Virginia.

"Equally entrepreneurs, Les and I accept learned the great amount of efficiency and resourcefulness required in the commencement-up procedure, and we have applied this in our search for financing as nosotros prepared to open our first frozen yogurt store," Claudia says. "Nosotros found BoeFly to be an ideal solution that offered us a variety of funding options and connected usa with a bank right in our area."

Retirement Accounts

This method is risky, but some people have found success with it. Instead of withdrawing coin early from your 401K or IRA, which would likely be subject field to extra taxes, you can set up a C corporation to be the owner and operator of the business. One time the C corporation is set up, you can roll the money into the corporation'south turn a profit sharing (or stock) program. Money within that program can and so be invested into the franchise.

As mentioned before, financing a franchise with money pegged for retirement is risky. If the business doesn't work out, you may accept significantly less coin, if any, to autumn dorsum on. If considering this option, it is paramount to speak with an accountant to avoid penalties from the IRS. BeneTrends Fiscal is a company that specializes in helping prospective small business organization owners apply retirement funds to fund their dreams.

Retirement account case study: For Glenn Burrell, franchise ownership gave him the opportunity to retire from the financial-services industry in New Jersey and change careers. "I wanted to own my own business, and franchising was the best style for me," he says. After several months of searching he landed in the applied science industry equally a franchisee of CMIT Solutions, an information technology consulting and calculator support services franchise.

After picking a franchise, Glenn researched ways to fund his venture, honing in on FranFund and BeneTrends. Afterwards careful consideration, he went with FranFund to assist him in using his 401(k) to fund the franchise.

Co-ordinate to Glenn, using his retirement fund as the path to franchise ownership fit his situation considering "instead of investing in other things, I saw an opportunity to invest in myself. I didn't have to worry about loans, interest, or operating loans. My funding experience was a very easy and obvious choice—rather than other alternatives—because those funds were sitting in my 401(1000) program."

The process of financing his franchise with his retirement funds took Glenn effectually four-to-six weeks. Glenn advises others seeking franchise funding "to make certain y'all practise the due diligence. Enquiry the business model thoroughly. If you can beget to overfund, especially with a 401(k), exercise so. It's better than getting cut curt."

Don't forget in that location are too plenty of small business loans and grants out there. Start with this list from the SBA, and don't give upward in your quest for financing your dream of franchise ownership.

Suggested reading:

- The Ultimate Guide to Franchising

- What is Franchising?

- The Benefits of Franchising

- Choosing the Most Profitable Franchise for You

- xi Primal Steps in Opening a Franchise

- Franchises vs. Business Opportunities

- The Toll to Start a Franchise and Financing Options

- Nuts of the Franchise Disclosure Certificate (FDD)

- Creating a Business organisation Plan for Your Franchise

- Completing and Signing a Franchise Agreement

Source: https://www.franchisedirect.com/ultimate-guide-to-franchising/cost-to-start-a-franchise/

Posted by: denhamgoolifter.blogspot.com

0 Response to "How Much Money Do I Need To Open A Franchise"

Post a Comment